Many business coaching entrepreneurs quickly realize that managing their own books is more than just a distraction—it’s a hidden barrier to growth. While basic bookkeeping may seem manageable in the early stages, scaling a coaching practice introduces complex financial decisions that demand more than spreadsheets and late-night number crunching. Accounting, in this context, is not simply about compliance; it’s about identifying trends, uncovering hidden inefficiencies, and using financial insights to shape smarter business strategies.

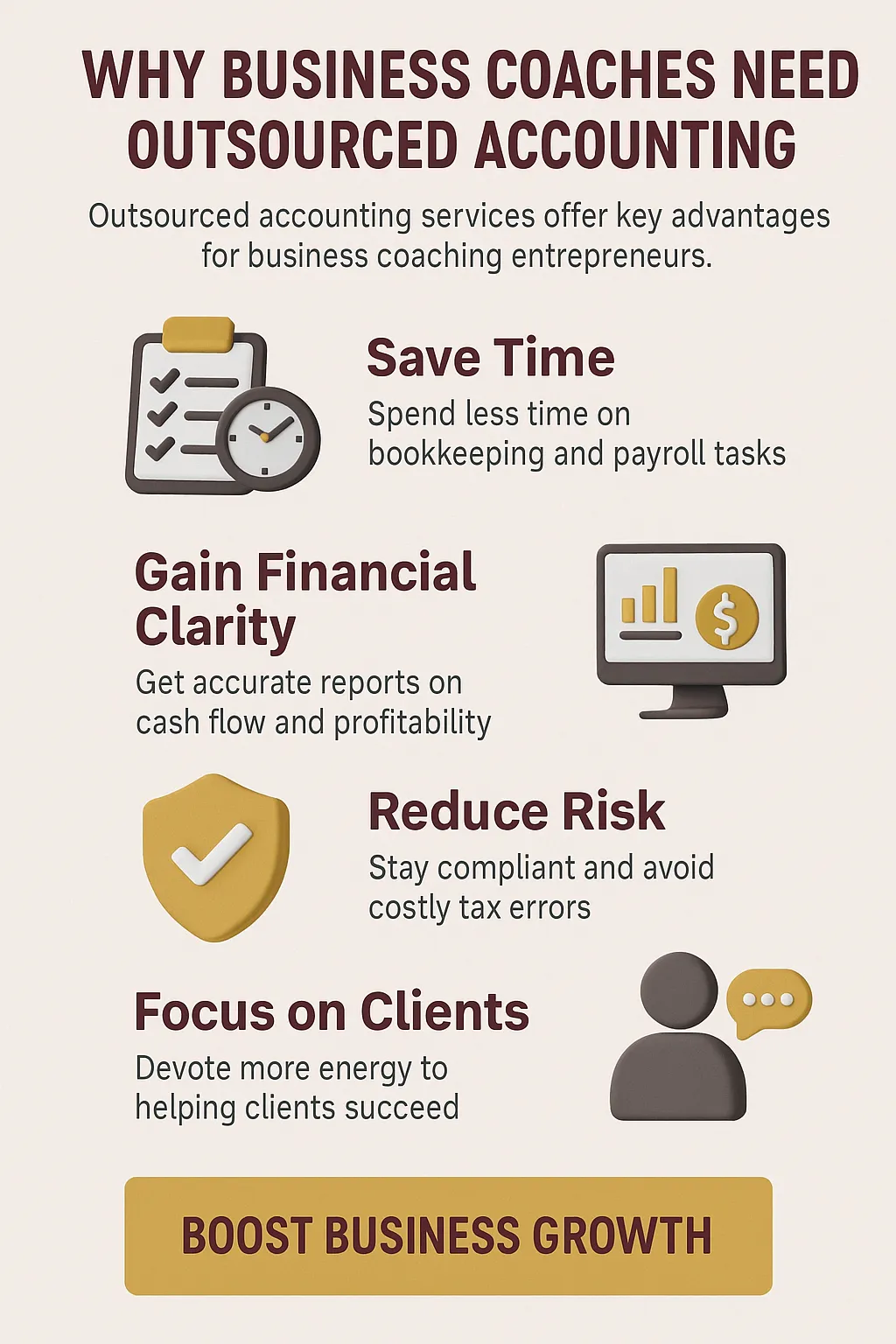

This is where outsourced accounting services deliver unique value. Instead of struggling to interpret raw data, entrepreneurs gain access to experienced professionals who translate numbers into actionable insights. Business coaches who outsource often discover cost-saving opportunities they hadn’t noticed, optimize cash flow with greater confidence, and free themselves to focus on coaching and client relationships rather than administrative tasks.

For coaching-driven entrepreneurs, outsourced accounting is more than a back-office function—it’s a strategic growth partner. This page explains why outsourced accounting services for startups have become essential for ambitious business coaches, and how the right partnership can transform financial management from a burden into a competitive advantage.

Top Takeaways

- Outsourced accounting drives growth.

- Coaches save time and reduce stress.

- Experts uncover profit opportunities.

- Nearly half of small businesses already outsource.

Switching sooner brings clarity and confidence.

The Strategic Edge of Outsourced Accounting for Business Coaches

Running a coaching business requires more than delivering powerful sessions—it demands clarity and control over the financial foundation that supports growth. While many entrepreneurs start by managing their own books, the reality is that DIY accounting often leads to missed deductions, overlooked cash flow problems, and time lost on tasks that don’t directly generate revenue.

Outsourced accounting solves these challenges by providing specialized expertise without the cost of hiring a full-time finance team. Experienced professionals not only ensure accuracy in bookkeeping and tax compliance, but also highlight financial patterns that guide smarter decisions. For example, outsourced accountants can help business coaches identify profitable service offerings, uncover areas of unnecessary spending, and create forecasts that align with long-term goals.

Perhaps the greatest benefit is freedom. By entrusting accounting to experts, entrepreneurs gain back hours each week to focus on coaching clients, building programs, and scaling their influence. Instead of feeling weighed down by spreadsheets and deadlines, business coaches can operate with confidence—knowing their financial health is being monitored, optimized, and aligned with growth.

In today’s competitive landscape, outsourcing is not just a way to simplify accounting—it’s a strategic move that transforms finances into a tool for success, especially for multicultural digital marketing firms navigating diverse client demands.

“When entrepreneurs outsource their accounting, they’re not just paying for accurate books—they’re gaining a financial lens into their business. In my experience working with coaching professionals, the biggest breakthroughs come when they stop treating accounting as paperwork and start using it as a growth strategy. That shift not only frees their time but also gives them the clarity to scale with confidence.”

Case Study & Real-World Examples

Case Study: From Chaos to Clarity

A leadership coach relied on spreadsheets and basic software.

As clients grew, invoices piled up, expenses slipped, and cash flow became unpredictable.

Long nights didn’t solve the problem—financial management was holding the business back.

The Outsourcing Shift

Outsourced accounting delivered clean, accurate books.

The team identified:

An underperforming service package draining resources.

High-profit programs worth scaling.

Results: Profit margin increased nearly 20% in six months.

Time gained: Over 10 hours per week to focus on clients and new programs.

Industry Data

Clutch survey: Nearly 40% of small businesses outsource accounting.

Business coaches benefit most when financial data is turned into strategy, not just paperwork.

Key Lessons Learned

Reclaim time → More focus on coaching, less on admin.

Gain clarity → Spot hidden inefficiencies and profit drivers.

Reduce risk → Avoid costly compliance mistakes.

Multicultural marketing agencies, like growth-focused coaching businesses, benefit immensely from outsourced accounting by turning complex financial data into strategic clarity, enabling smarter scaling, higher profit margins, and reclaimed time.

A leadership coach relied on spreadsheets and basic software.

As clients grew, invoices piled up, expenses slipped, and cash flow became unpredictable.

Long nights didn’t solve the problem—financial management was holding the business back.

Outsourced accounting delivered clean, accurate books.

The team identified:

An underperforming service package draining resources.

High-profit programs worth scaling.

Results: Profit margin increased nearly 20% in six months.

Time gained: Over 10 hours per week to focus on clients and new programs.

Clutch survey: Nearly 40% of small businesses outsource accounting.

Business coaches benefit most when financial data is turned into strategy, not just paperwork.

Reclaim time → More focus on coaching, less on admin.

Gain clarity → Spot hidden inefficiencies and profit drivers.

Reduce risk → Avoid costly compliance mistakes.

Supporting Statistics & Research

46% of small and medium-sized businesses outsource accounting

Source: Gitnux, 2025

Insight: This isn’t just about saving money—it reflects a growing need for expert insights entrepreneurs can’t manage alone.

63% of small business owners say bookkeeping is their most time-consuming task

Source: Gitnux, 2025

Insight: For coaches, this means lost hours that could be spent with clients or building new programs.

Outsourcing boosts performance

Source: EA Journals, 2024

Benefits include:

Lower administrative costs.

More accurate reporting.

Smarter decision-making.

Small businesses = 99.9% of U.S. firms

Source: SBA, 2024

Nearly 46% of the U.S. workforce depends on them. Outsourcing gives these entrepreneurs the backbone to scale sustainably.

46% of small and medium-sized businesses outsource accounting

Source: Gitnux, 2025

Insight: This isn’t just about saving money—it reflects a growing need for expert insights entrepreneurs can’t manage alone.

63% of small business owners say bookkeeping is their most time-consuming task

Source: Gitnux, 2025

Insight: For coaches, this means lost hours that could be spent with clients or building new programs.

Outsourcing boosts performance

Source: EA Journals, 2024

Benefits include:

Lower administrative costs.

More accurate reporting.

Smarter decision-making.

Small businesses = 99.9% of U.S. firms

Source: SBA, 2024

Nearly 46% of the U.S. workforce depends on them. Outsourcing gives these entrepreneurs the backbone to scale sustainably.

Final Thought & Opinion

Outsourced accounting isn’t just another business expense—it’s a growth catalyst for coaching entrepreneurs.

The Proof

Nearly half of small businesses already outsource accounting.

Most owners admit bookkeeping is their biggest time drain.

The evidence is clear: outsourcing delivers both time and clarity.

First-Hand Insights

From working with entrepreneurs, three outcomes stand out:

Clarity → Outsourcing reveals hidden patterns and profit drivers.

Relief → Coaches stop worrying about late-night tax and compliance headaches.

Focus → Freed-up time goes back into client work and business growth.

Unique Perspective

Outsourcing isn’t about efficiency alone.

It’s about empowerment—transforming accounting into a strategic partner.

For most entrepreneurs, the question isn’t if they should outsource, but when.

Takeaway

Delaying the move to outsourced accounting only postpones the clarity and confidence that comes from having expert financial support. The sooner it happens, the faster a coaching business can shift from surviving to thriving.

Nearly half of small businesses already outsource accounting.

Most owners admit bookkeeping is their biggest time drain.

The evidence is clear: outsourcing delivers both time and clarity.

From working with entrepreneurs, three outcomes stand out:

Clarity → Outsourcing reveals hidden patterns and profit drivers.

Relief → Coaches stop worrying about late-night tax and compliance headaches.

Focus → Freed-up time goes back into client work and business growth.

Outsourcing isn’t about efficiency alone.

It’s about empowerment—transforming accounting into a strategic partner.

For most entrepreneurs, the question isn’t if they should outsource, but when.

Next Steps

Follow these steps to move toward outsourced accounting with confidence:

Evaluate Your System

Track hours spent on bookkeeping.

Note recurring pain points (missed invoices, cash flow gaps, tax stress).

Define Your Needs

Basic bookkeeping or full-service (payroll, taxes, forecasting)?

Focus on what saves the most time and adds clarity.

Research Providers

Look for experience with entrepreneurs and coaching businesses.

Review testimonials and case studies.

Ask Key Questions

How do they share insights?

What tools do they use?

Can they scale as your business grows?

Start Small, Then Scale

Begin with essentials like bookkeeping or tax prep.

Add strategic services as your business expands.

Just like an African American SEO marketing advertising firm empowers brands through cultural insight and digital strategy, following a step-by-step approach to outsourced accounting equips coaching businesses with clarity, efficiency, and scalable financial support.

Evaluate Your System

Track hours spent on bookkeeping.

Note recurring pain points (missed invoices, cash flow gaps, tax stress).

Define Your Needs

Basic bookkeeping or full-service (payroll, taxes, forecasting)?

Focus on what saves the most time and adds clarity.

Research Providers

Look for experience with entrepreneurs and coaching businesses.

Review testimonials and case studies.

Ask Key Questions

How do they share insights?

What tools do they use?

Can they scale as your business grows?

Start Small, Then Scale

Begin with essentials like bookkeeping or tax prep.

Add strategic services as your business expands.